What is escrow?

Simply defined, an escrow is a deposit of funds, a deed or other instrument by one party for the delivery to another party upon completion of a particular condition or event. The California Escrow Law, Section 17003, provides the complete legal requirements.

Why do I need escrow?

Whether you are a buyer, seller, lender or borrower, you want assurance that no funds or property will change hands until all of the instructions in the transaction have been followed. The escrow holder has the obligation to safeguard the funds and/or documents while they are in the possession of the escrow holder, and to disburse funds, and/or convey title only when all provisions of the escrow have been complied with.

How does it work?

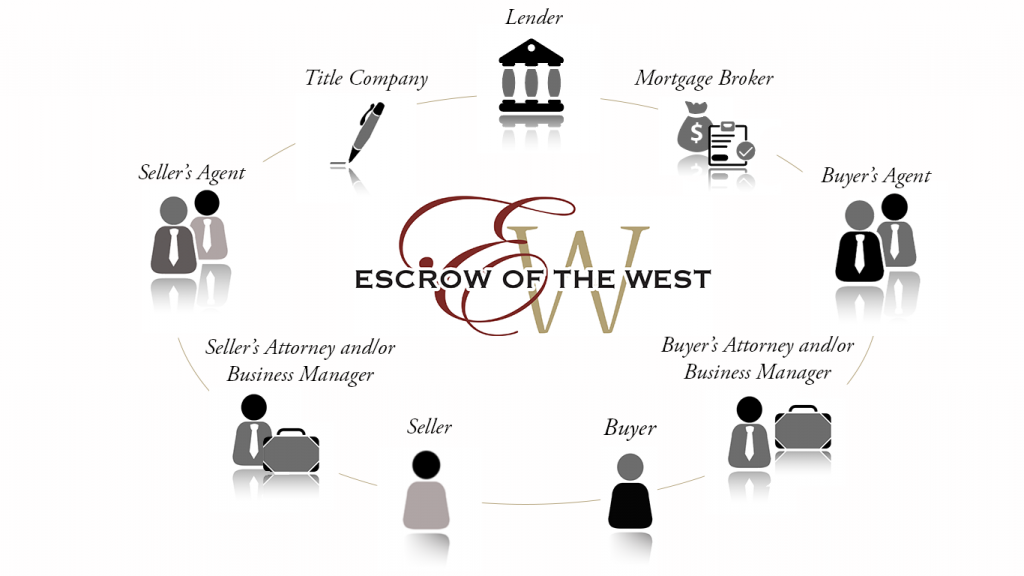

The principals to escrow—buyer, seller, lender, borrower—cause written escrow instruction to be created, signed and delivered to the escrow officer. If a broker is involved, he or she will normally provide the escrow officer with the information necessary for the preparation of your escrow instruction and document.

The escrow officer will create escrow instruction and process the escrow, in accordance with the escrow instruction. When all conditions required in the escrow can or have been met or achieved, the escrow will be “closed.” Each escrow, although following a similar pattern, will be different in some respects, as it deals with your property and the transaction at hand.

The duties of an escrow holder include following instruction given by the principals and parties to the transaction in a timely manner, handling the funds and/or documents in accordance with the instruction, paying all bills as authorized, responding to the authorized requests from the principals, closing the escrow only when all terms and conditions have been met, distributing the funds in accordance with the instruction and providing an accounting for the same—the Closing or Settlement Statement.

How do I choose escrow?

The selection of the escrow holder is normally done by agreement between the principals. If a real estate broker is involved in the transaction, the broker may recommend an escrow holder. However, it is the right of the principals to use an escrow holder who is competent and who is experienced in handling the type of escrow at hand. There are laws that prohibit the payment of referral fees; this affords the consumer the best possible escrow services without any compromise caused by a person receiving a referral fee.

What can I do to expedite the process?

During escrow, the key to any transaction is to read and understand your escrow instructions. If you do not understand them, you should ask your escrow officer to explain the instructions. Your escrow officer is not an attorney and cannot practice law. You should consult your lawyer for legal advice. Do not expect your escrow officer to advise you as to whether or not you have a “good deal” or are doing things the right way. The officer is there to follow the instruction given by the principals in the escrow.

In order to expedite the closing of the escrow, you should check with your escrow officer as to what specific items you could assist with. Ask “What can i do to expedite the closing of this escrow?” and respond quickly to correspondence. This will assist in the timely closing of the transaction.

How long can I expect the process to take?

When the escrow officer closes the escrow, some of you may want the closing papers, check, title policies provided by the title company and statements made available immediately. There are many aspects to the closing of the escrow, and some of these cannot be processed on the day of the closing. They may take several days. If you have a special need, for example a cashier’s check on the day of closing, you should communicate that need to the escrow officer early in the processing of the escrow.

What is a closing statement?

A closing statement is an accounting, in writing, prepared at the close of escrow, which sets forth the charges and credits of your account. The items shown on the statement will reflect the purchase price, the funds deposited or credited to your account, payoffs on existing encumbrances and/or liens, the costs for all services and determination of the funds due you at the close of the escrow. When you receive your closing papers, review the closing statement for accuracy; it is extremely logical and reflects the financial aspects of your transaction. If anything does not make sense to you, you should ask your escrow officer for an explanation.